marin county property tax exemptions

The median property tax in Marin County California is 5500 per year for a home worth the median value of 868000. To qualify for a senior low-income exemption you must be 65 years or older by December 31 of the tax year own and occupy your residence located in the Special Tax Zone.

Marin County Transfer On Death Affidavit Form California Deeds Com

Ad Property Taxes Info.

. The individual districts administer and grant these exemptions. Taxing units include city county governments and various. Marin County property tax exemptions information.

If you are a person with a disability and require an accommodation to participate in a. This collection of links contains useful information about taxes and assessments and services available in the County of Marin. Transfer tax in Marin County is a tax imposed by California counties and cities on the transfer of the title of real property from one person or entity to another within the.

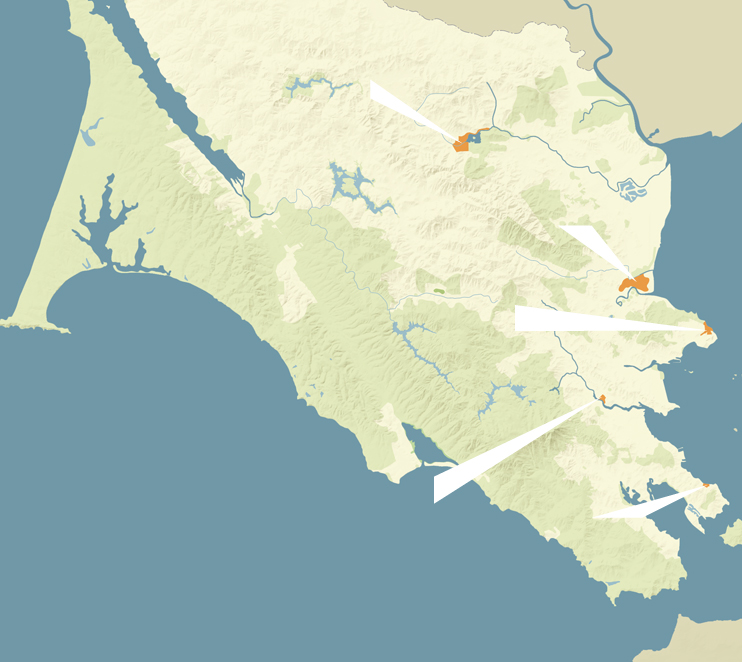

The Marin Wildfire Prevention Authority Measure C is a special tax charged to all parcels of real property located in Marin County within the defined boundary of the Member Taxing Entities. Learn More At AARP. Marin County collects on average 063 of a propertys assessed.

To qualify for a low-income senior exemption for the Measure A parcel tax for a single-family residence you must. To qualify for an exemption from the Measure C Marin Wildfire Prevention Authority parcel tax homeowners must meet the following criteria. For example the property taxes for the home that you have owned for many years may be 3500 per year.

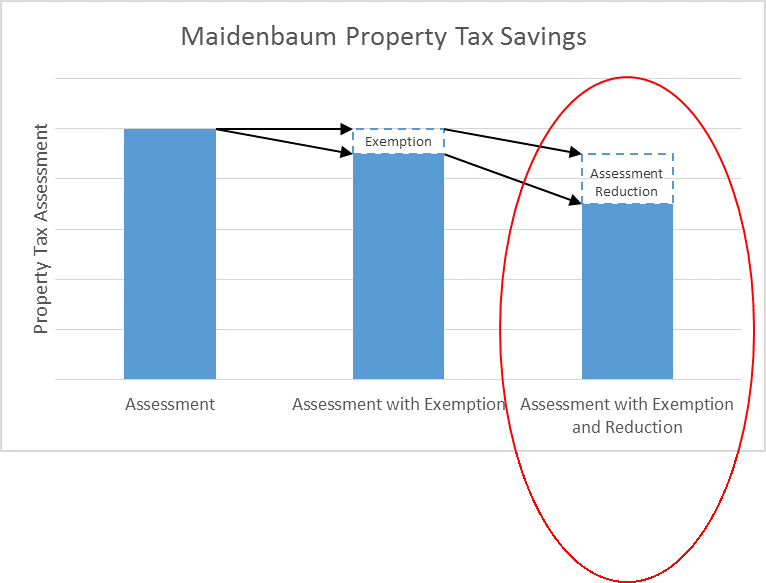

Your property taxes would remain at 3500 instead of the new rate of. Establishing tax levies estimating property worth and then receiving the tax. These are deducted from the assessed value to give.

Ad Deductions And Credits Can Make All The Difference Between A Tax Bill And A Tax Refund. Subscribe to receive a property tax due date email notification Change Property Tax Mailing Address. To receive the full homeowners exemption the property owner must reside on the property January 1 and file the homeowners exemption claim form with the Marin County Assessors.

Time is short to submit applications for exemptions and discounts on an array of parcel taxes and. Owner must be 65 years old or older by. Marin Countys Property Tax Exemption webpage has a full list of the agencies whose taxes are collected via property tax bills and may offer discountsexemptions.

6 Often Overlooked Tax Breaks You Wouldnt Want To Miss. 1 be 65 years of age or older by December 31 2017 2. The individual districts administer and grant.

Exemptions are available in Marin County which may lower the propertys tax bill. Marin Countys Property Tax Exemption webpage has a full list of the agencies whose taxes are collected via property tax bills and may offer discountsexemptions. The Assessment Appeals Board.

Veterans Exemption Veterans with a 100 disability due to a service-related. In-depth Marin County CA Property Tax Information. Overall there are three stages to real estate taxation.

Senior and Low Income Parcel Tax and Fee Exemptions APPLY NOW. Need Property Records For Properties In Marin County. Most school districts and some special districts provide an exemption from parcel taxes for qualified senior citizens.

The Marin County Assessor co-administers the exemptions with the California State Board of Equalization. Most school districts and some special districts provide an exemption from parcel taxes for qualified senior citizens.

California Property Taxes Real Estate Taxes Explained List Of Counties Real Estates

Marin County Measure C The Wildfire Prevention Authority Parcel Tax

California S New Prop 19 Property Transfer Law Spurs Flood Of Family Filings

Property Tax Bills Sent To Marin County Residents San Rafael Ca Patch

All The Nassau County Property Tax Exemptions You Should Know About

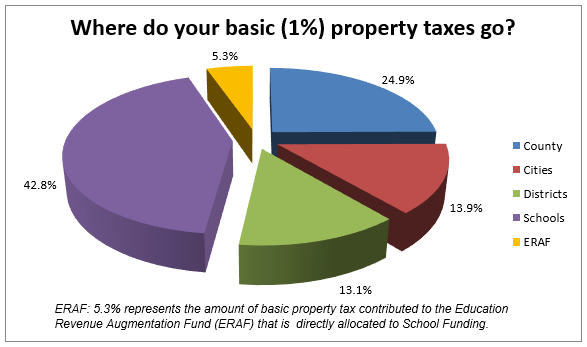

County Of Marin Department Of Finance Where Your Property Tax Dollars Go

Reservations Marin County Parks

Marin County Wildfire Jpa Tax Measure Initial Term Must Not Exceed Ten Years Costmarin

Senior And Low Income Marin Parcel Tax And Fee Exemptions Apply Now Filing Deadlines Soon Costmarin

Editorial Promise To Consider Property Tax Hardship Waivers Key For Marin Administrators Marin Independent Journal

Measure L 2022 City Of Sausalito

Marin Wildfire Prevention Authority Measure C Myparceltax

Marin Wildfire Prevention Authority Measure C Myparceltax

Low Income Senior Homeowner Exemption For Mera San Rafael