virginia estimated tax payments due dates 2021

The District of Columbia has not moved its individual filing deadline. 2022 Tax Calendar.

Sample Letter Offer To Junior Lienholder Lettering Letter Templates Real Estate Forms

Which the estimated payment is made not the ending date for the quarter the estimated payment is made.

. Amount Overpayment Credit Applied Total Amount Paid 2ND PAYMENT 3RD PAYMENT 4TH PAYMENT TOTALS Payments must be submitted electronically using eForms. Estimated income tax payments must be made in full on or before May 1 2022 or in equal installments on or before May 1 2022 June 15. Make tax due estimated tax and extension payments.

Estimated income tax payments must be made in full on or before May 1 2021 or in equal installments on or before May 1 2021 June 15. West Virginia Code 16A-9-1 d Sales and Use Tax. In addition if you dont elect voluntary withholding you should make estimated tax payments on other.

This relief does not apply to estimated tax payments for the 2021 tax year that are due on April 15 2021. Make estimated payments online or file Form 760ES Payment Voucher 1 by May 1 2021. If you file your return after March 1 without making the January payment or if you have not paid the proper amount of estimated tax on any earlier due date you may be liable for an additional charge for.

For the 2022 tax year you can pay all your estimated tax by April 18 2022 or you can pay them in four equal amounts by the dates shown. Typically most people must file their tax return by May 1. Is still due April 15.

Make estimated payments online or file Form 760ES Payment Voucher 1 by May 1 2022. Pay bills or set up a payment plan for all individual and business taxes. Estimated tax payments should be mailed by the due date to.

Set up or log in securely at MyTaxesWVTaxGov to access personal tax account information including balance payments and tax records including adjusted gross income. If the ending month for the taxable year. Individual Income Tax Filing Due Dates.

This means that taxpayers need to pay. Additions to tax are imposed for failure to pay all tax shown to be due on a return on or before the due date determined without regard to an extension of time to file. Monthly and First Quarter.

Make final estimated tax payments for 2021 by Tuesday January 18 2022 to help avoid a possible assessment for taxes owed and penalties. 54 rows under normal circumstances quarterly estimated tax payments for tax. Box 342 Charleston WV 25322-0342 _____ DONNA J.

Important Tax Due Dates and Deadlines. If the due date falls on a Saturday Sunday or holiday you have until the next business day to file with no penalty. Quarterly estimated taxes for the months from September 1 December 31 of 2021 are due on this date.

Use Form 1040-ES to figure and pay your estimated tax for 2022. Under normal circumstances quarterly estimated tax payments for tax year 2020 would have come due april 15 june 15 and september 15 of this year with the final payment due on january 15 2021. However you dont have to make this payment if you file your 2021 return Form 1040 or Form 1040-SR and pay any tax due by January 31 2022.

Estimated tax is the method used to pay tax on income that isnt subject to withholding for example earnings from self-employment interest dividends rents alimony etc. The tax shall be due and payable on the 20th day of January April July and October for the preceding calendar quarter. West Virginia Code 16A-9-1d Sales and Use Tax.

VIRGINIA ESTIMATED INCOME TAX PAYMENT VOUCHERS 2022 FOR INDIVIDUALS FORM 760ES Form 760ES Vouchers and Instructions wwwtaxvirginiagov Effective for payments made on and after July 1 2021 individuals must submit all income tax payments electronically if any payment exceeds 2500 or the sum of all payments is expected to exceed 10000. IT-140ES Individual Estimated Income Tax Payment Form IT140ES STATE OF WEST VIRGINIA State Tax Department Tax Account Administration Div PO. 00 2021 ESTIMATED TAX PAYMENT RECORD Date PAYMENT MADE WITH DECLARATION Check or Money Order No.

West Virginia State Tax Department Tax Account Administration Division Est PO Box 342 Charleston WV 25322-0342 It is also possible to make estimated payments online through Mytaxes at mytaxeswvtaxgov. If you file your 2021 income tax return and pay the balance of tax due in full by March 1 2022 you are not required to make the estimated tax payment that would normally be due on January 15 2022. If you file Federal estimated payments April 15 is still your due date for the first quarter 2021 estimated tax payment.

Pay all business taxes including sales and use employer withholding corporate income and other miscellaneous taxes. The tax shall be due and payable on the 20th day of January April July and October for the preceding calendar quarter. Taxpayers who paid too little tax during 2021 can still avoid a surprise tax-time bill and possible penalty by making a quarterly estimated tax payment now directly to the Internal Revenue Service.

The deadline for making a payment for the fourth quarter of 2021 is Tuesday January 18 2022. Enter here and on Line 2 of the next voucher due4. If you file your return after March 1 without making the January payment or if you have not paid the proper amount of estimated tax on any earlier due date.

Returns are due the 15th day of the 4th month after the close of your fiscal year. Income taxes are pay-as-you-go. CST-200CU Sales and Use Tax Return Instructions Import Spreadsheet.

AAROE Name 17 CLUB HOUSE DR _____ Address EVANS WV 25241-9402 _____ City State Zip Letter Id. Interest and penalties will not accrue if payment requirements are met by May 17 2021. Individual returns and 2021 first quarter estimated payments are still due April 15.

Vermont announced the postponement of the 2020 personal income tax filing and payment due date to May 17 2021. Virginia estimated tax payments due dates 2020. The additions to tax for late payment are imposed at the rate of one half of one percent 005 per month or part of a month not to exceed twenty five percent 25.

Q4 January 15 Jan 17th 2022 due to the 15th falling on the weekend. If you file Virginia estimated payments keep an eye on May 1. If you file your state income tax return and pay the balance of tax due in full by March 1 you are not required to make the estimated tax payment that would normally be due on Jan.

Browse Our Image Of Notice To Pay Or Quit Template Templates Paying Quites

List Of Virginia Locations By Per Capita Income Wikipedia

West Virginia Estate Tax Everything You Need To Know Smartasset

List Of Virginia Locations By Per Capita Income Wikipedia

Virginia State Taxes 2022 Tax Season Forbes Advisor

Do You Have Enough Money In 2021 Budget Help Budgeting Tips Ways To Save Money

Virginia Income Tax Calculator Smartasset

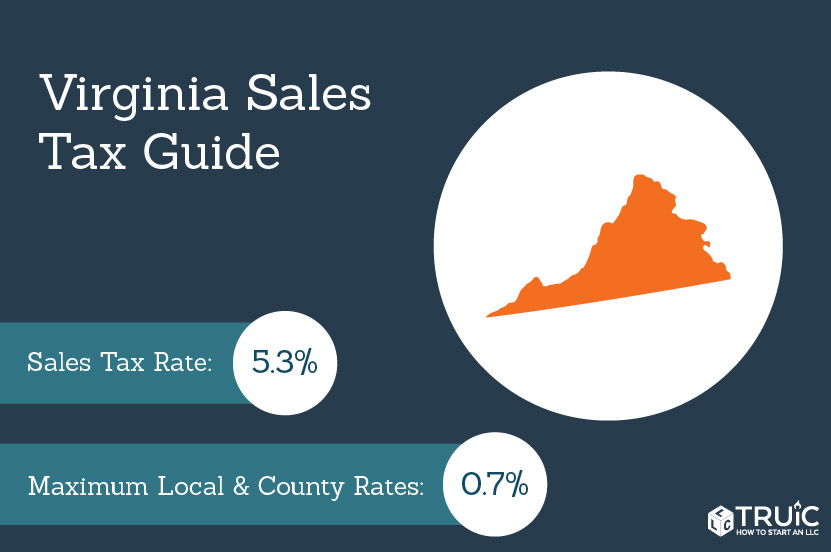

Virginia Sales Tax Small Business Guide Truic

Where S My Refund Virginia H R Block

Mortgage Calculator With Escrow Excel Spreadsheet Mortgage Amortization Calculator Mortgage Loan Calculator Mortgage Payment Calculator

Virginia Company Of London Encyclopedia Virginia

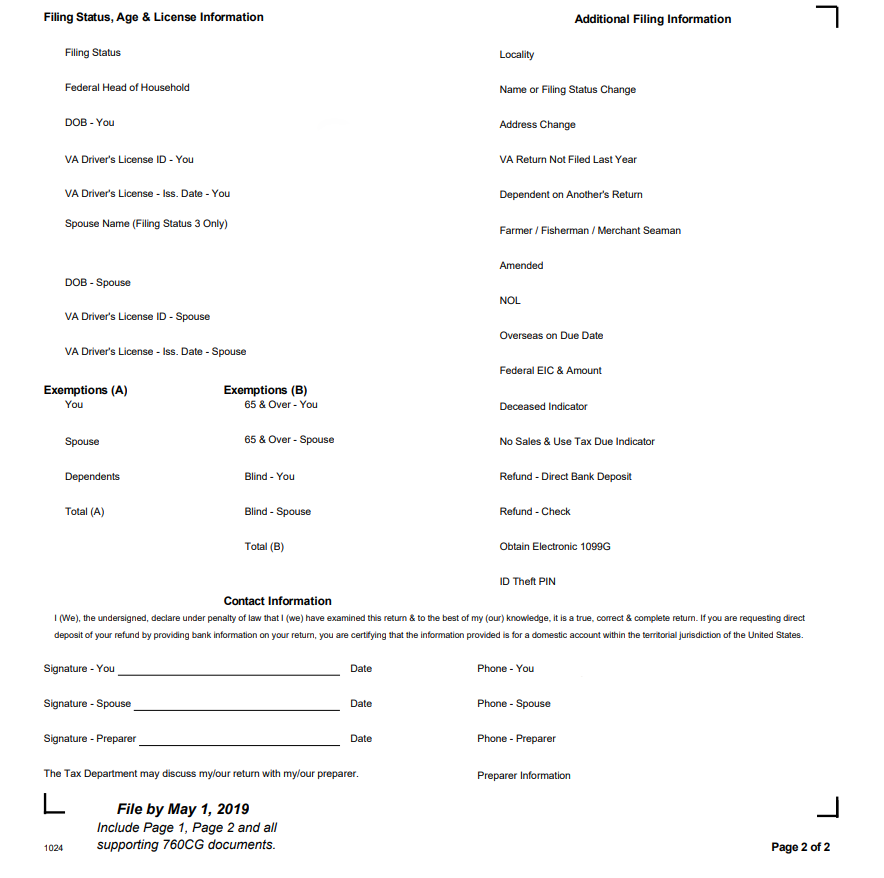

Instructions On How To Prepare Your Virginia Tax Return Amendment

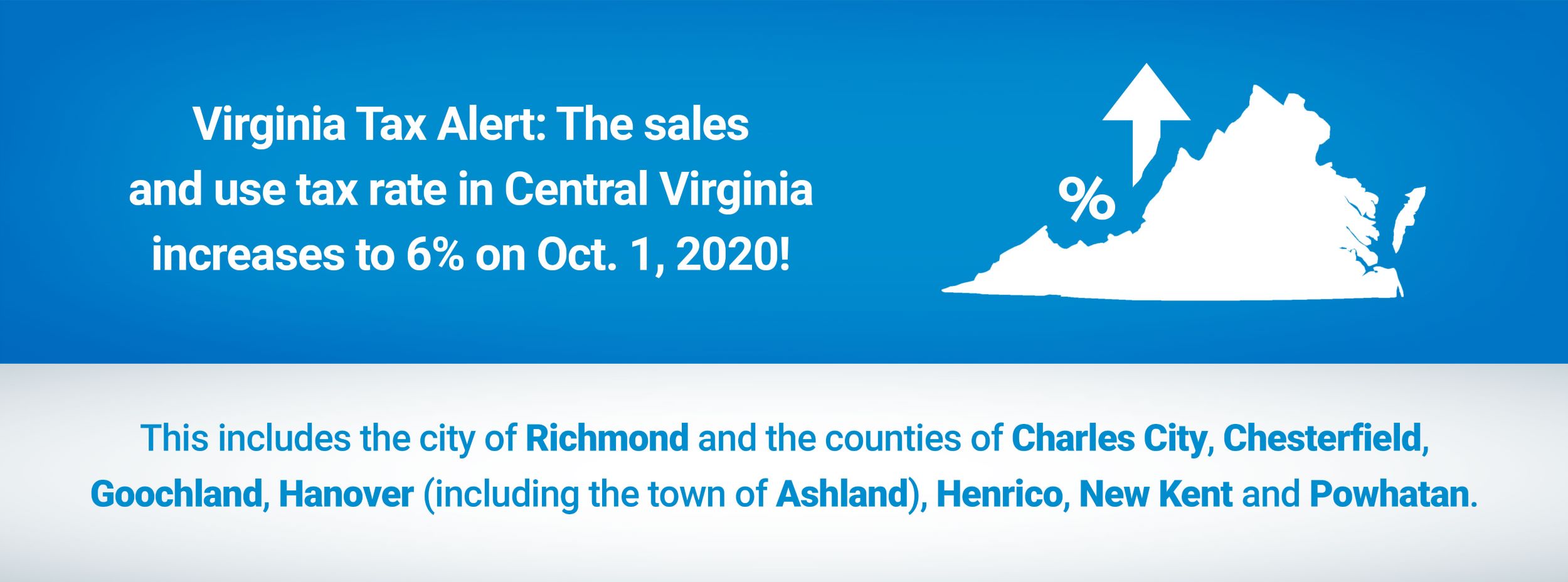

Sales Tax Increase In Central Virginia Region Beginning Oct 1 2020 Virginia Tax

Va Disability Pay Schedule 2022 Update Hill Ponton P A

Virginia Retirement Tax Friendliness Smartasset

The Housing Supply Shortage State Of The States Freddie Mac Minneapolis City Millennials Generation Economic Indicator

Va Loan Calculator For Florida Mortgage Loan Calculator Va Loan Calculator Va Loan